All Categories

Featured

Table of Contents

These financiers are assumed to have the financial elegance and experience called for to review and spend in high-risk financial investment opportunities hard to reach to non-accredited retail financiers. In April 2023, Congressman Mike Flood introduced H.R.

Dynamic Tax-advantaged Investments For Accredited Investors

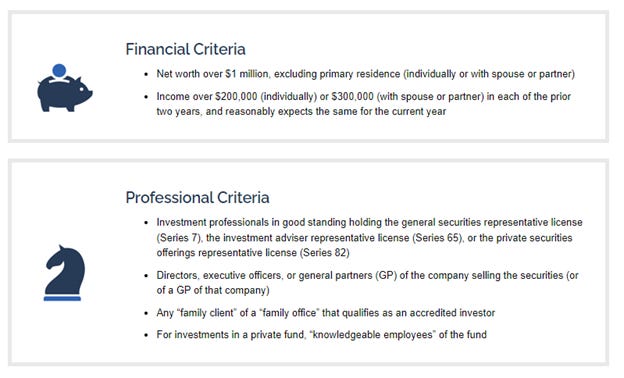

For now, investors must abide need to follow term's existing definition. There is no formal process or government qualification to become an accredited financier, an individual might self-certify as an approved capitalist under present policies if they gained more than $200,000 (or $300,000 with a partner) in each of the past 2 years and anticipate the same for the current year.

Individuals with an active Series 7, 65, or 82 certificate are likewise taken into consideration to be certified capitalists. Entities such as companies, collaborations, and counts on can additionally achieve recognized financier standing if their financial investments are valued at over $5 million.

Below are a few to consider. Personal Equity (PE) funds have actually shown amazing development in the last few years, seemingly undeterred by macroeconomic difficulties. In the third quarter of 2023, PE deal volume went beyond $100 billion, about on par with offer activity in Q3 of the previous. PE companies swimming pool resources from accredited and institutional investors to obtain regulating interests in mature personal business.

In enhancement to capital, angel capitalists bring their expert networks, guidance, and knowledge to the start-ups they back, with the assumption of endeavor capital-like returns if the company takes off. According to the Facility for Venture Study, the average angel investment amount in 2022 was about $350,000, with capitalists getting an average equity risk of over 9%.

Leading Accredited Investment Platforms Near Me (Philadelphia)

That claimed, the development of on the internet exclusive credit scores systems and niche sponsors has actually made the property class obtainable to individual certified financiers. Today, capitalists with as low as $500 to spend can make the most of asset-based exclusive credit scores opportunities, which offer IRRs of approximately 12%. Despite the increase of e-commerce, physical grocery store stores still make up over 80% of grocery sales in the United States, making themand specifically the realty they operate out oflucrative financial investments for accredited capitalists.

In comparison, unanchored strip centers and community facilities, the next two most greatly negotiated kinds of actual estate, videotaped $2.6 billion and $1.7 billion in purchases, specifically, over the exact same period. However what are grocery store store-anchored facilities? Suv strip shopping malls, outlet shopping malls, and other retail centers that feature a major food store as the area's major occupant generally drop under this group, although shopping malls with enclosed walkways do not.

Recognized capitalists can spend in these areas by partnering with genuine estate exclusive equity (REPE) funds. Minimum financial investments normally start at $50,000, while total (levered) returns range from 12% to 18%.

High-Quality Investment Opportunities For Accredited Investors Near Me (Philadelphia Pennsylvania)

Over the last decade, art has made ordinary annual returns of 14%, trouncing the S&P 500's 10.15%. The marketplace for art is additionally broadening. In 2022, the worldwide art market grew by 3% to $67.8 billion. By the end of the years, this number is expected to approach $100 billion.

Capitalists can now possess diversified personal art funds or acquisition art on a fractional basis. These choices feature investment minimums of $10,000 and offer net annualized returns of over 12%. Equity capital (VC) proceeds to be just one of the fastest-growing possession courses worldwide. Today, VC funds boast more than $2 trillion in AUM and have actually deployed greater than $1 trillion into venture-backed startups because 2018including $29.8 billion in Q3 2023 alone.

Over the past a number of years, the recognized capitalist definition has actually been slammed on the basis that its sole concentrate on an asset/income test has unfairly excluded almost the richest people from rewarding financial investment opportunities. In reaction, the SEC began taking into consideration means to increase this interpretation. After an extensive comment duration, the SEC embraced these modifications as a way both to capture people that have trusted, different indications of monetary class and to update certain out-of-date sections of the interpretation.

The SEC's key problem in its law of unregistered securities offerings is the protection of those capitalists that lack an adequate degree of economic sophistication. This issue does not apply to educated employees since, by the nature of their position, they have adequate experience and access to monetary info to make informed financial investment choices.

Value Secure Investments For Accredited Investors (Philadelphia)

The establishing variable is whether a non-executive employee in fact takes part in the exclusive investment business's investments, which have to be established on a case-by-case basis. The enhancement of knowledgeable employees to the certified capitalist meaning will additionally permit even more employees to buy their company without the exclusive investment firm risking its own condition as an approved capitalist.

Prior to the amendments, some personal investment firms took the chance of shedding their certified capitalist condition if they permitted their workers to buy the firm's offerings. Under the changed interpretation, a higher number of private investment firm staff members will now be eligible to invest. This not just creates an added resource of funding for the exclusive financial investment firm, yet additionally more straightens the interests of the worker with their employer.

Trusted Passive Income For Accredited Investors Near Me – Philadelphia

Currently, only individuals holding certain broker or economic consultant licenses ("Series 7, Series 65, and Collection 82") qualify under the definition, however the amendments grant the SEC the capacity to include additional certifications, classifications, or credentials in the future. Specific types of entities have also been included in the definition.

When the definition was last upgraded in 1989, LLCs were fairly unusual and were not consisted of as an eligible entity. Under the modifications, an LLC is considered a recognized financier when (i) it has at least $5,000,000 in assets and (ii) it has not been formed entirely for the details objective of obtaining the securities used.

Certain family members offices and their customers have actually been added to the definition. A "family office" is an entity that is established by a family to manage its properties and provide for its future. To make sure that these entities are covered by the interpretation, the amendments state that a family members workplace will now certify as an approved capitalist when it (i) handles at the very least $5,000,000 in assets, (ii) has actually not been developed specifically for the purpose of obtaining the provided safeties, and (iii) is directed by a person that has the economic elegance to review the benefits and risks of the offering.

The SEC requested comments concerning whether the financial limits for the income and property tests in the definition need to be readjusted. These limits have actually remained in area since 1982 and have not been readjusted to represent inflation or other factors that have actually changed in the stepping in 38 years. The SEC inevitably decided to leave the asset and revenue limits unmodified for currently (investment opportunities for accredited investors).

Latest Posts

Property Tax Not Paid For 10 Years

How To Invest In Tax Lien

High Yielding Investments In Tax Lien Certificates