All Categories

Featured

Table of Contents

The SEC regulates the guidelines for dealing safeties including when and how protections or offerings have to be signed up with the SEC and what kinds of capitalists can take part in a certain offering - high yield investments for accredited investors. As an on-line commercial property spending marketplace, every one of our financial investment chances are readily available just to approved capitalists

Place just, you're a recognized financier if: OR ORYou are an owner in great standing of the Series 7, Series 65, or Collection 82 licenses A recognized financier does not have to be a specific person; trust funds, particular pension, and LLCs may also get approved for certified capitalist standing. Each investing capability may have somewhat different standards to be considered recognized, and this flowchart lays out the certification requirements for all entity types.

Within the 'accreditation verification' tab of your, you will certainly be given the complying with alternatives. Upload financials and paperwork to reveal evidence of your recognized condition based upon the demands summarized above. vouching for your status as a recognized financier. The uploaded letter has to: Be signed and dated by a certified third-party; AND Clearly state the service providers credentials (ex-spouse, "I am a signed up certified public accountant in the State of [], permit #"); AND explicitly state that the investor/entity is a recognized financier (as specified by Guideline 501a).

Tailored Investments For Accredited Investors Near Me

Please note that third-party letters are just valid for 90 days from day of issuance. Per SEC Regulation 230.506(c)( 2 )(C), before approving an investor right into an offering, sponsors should acquire written evidence of a capitalist's certification status from a certified third-party. If a third-party letter is supplied, this will be passed to the enroller directly and should be dated within the previous 90 days.

After a year, we will certainly require upgraded financial records for review. To find out more on accredited investing, visit our Accreditation Introduction posts in our Assistance Center.

The test is expected to be readily available at some point in mid to late 2024. The Equal Opportunity for All Investors Act has currently taken a substantial action by passing your house of Reps with an overwhelming vote of assistance (383-18). private placements for accredited investors. The following phase in the legislative procedure entails the Act being evaluated and elected upon in the Us senate

Top Accredited Property Investment Near Me (Mesa)

Provided the speed that it is relocating already, this might be in the coming months. While specific timelines are unclear, offered the significant bipartisan support behind this Act, it is expected to progress with the legislative process with loved one speed. Presuming the one-year window is given and accomplished, suggests the message would be offered sometime in mid to late 2024.

For the average capitalist, the economic landscape can sometimes feel like a complex labyrinth with minimal accessibility to specific financial investment opportunities. Most financiers do not qualify for accredited capitalist condition due to high income degree requirements.

Exclusive Hedge Funds For Accredited Investors Near Me

Join us as we debunk the world of certified financiers, unwinding the meaning, needs, and potential advantages connected with this designation. Whether you're brand-new to spending or seeking to expand your financial horizons, we'll clarify what it means to be a certified capitalist. While services and financial institutions can qualify for recognized investments, for the objectives of this short article, we'll be reviewing what it suggests to be an accredited financier as a person.

Private equity is likewise an illiquid asset course that looks for long-lasting appreciation far from public markets. 3 Exclusive placements are sales of equity or debt placements to professional capitalists and establishments. This sort of financial investment typically functions as an option to various other strategies that might be required to increase capital.

7,8 There are several downsides when considering a financial investment as a recognized investor. For example, start-up businesses have high failing rates. While they might appear to provide incredible capacity, you might not redeem your preliminary investment if you get involved. 2 The investment lorries used to certified investors commonly have high investment demands.

2 Bush funds, in particular, may have linked costs, such as performance and management charges. An efficiency cost is paid based upon returns on an investment and can range as high as 15% to 20%. This is on top of management fees. 9 Numerous recognized investment vehicles aren't easily made liquid must the demand develop.

Experienced Hedge Funds For Accredited Investors

The information in this product is not intended as tax or lawful guidance. It might not be made use of for the objective of avoiding any kind of federal tax obligation penalties. Please consult legal or tax professionals for details details regarding your private circumstance. This material was established and created by FMG Suite to supply details on a subject that may be of rate of interest.

The viewpoints revealed and worldly supplied are for basic details, and must not be taken into consideration a solicitation for the acquisition or sale of any protection. Copyright FMG Collection.

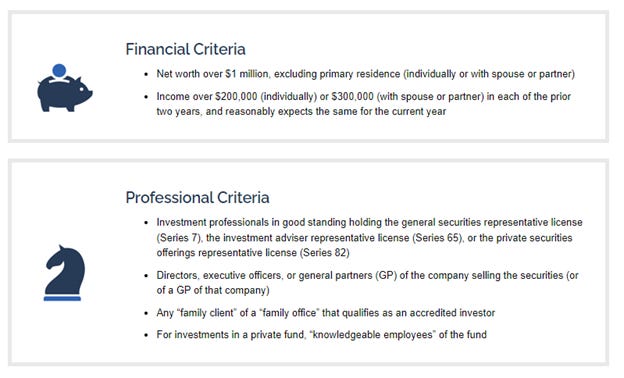

Certified investors consist of high-net-worth individuals, financial institutions, insurance policy firms, brokers, and counts on. Approved capitalists are specified by the SEC as qualified to buy facility or innovative sorts of protections that are not closely managed. Specific requirements need to be met, such as having a typical annual earnings over $200,000 ($300,000 with a spouse or domestic companion) or operating in the financial industry.

Non listed securities are naturally riskier since they do not have the regular disclosure needs that feature SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have fortunate access to pre-IPO companies, equity capital firms, hedge funds, angel financial investments, and numerous bargains entailing facility and higher-risk investments and instruments. A business that is seeking to elevate a round of financing may decide to straight come close to recognized investors.

Tailored Passive Income For Accredited Investors Near Me – Mesa

It is not a public company but wants to introduce a going public (IPO) in the future. Such a firm could make a decision to provide safety and securities to certified financiers directly. This sort of share offering is described as a exclusive placement. For recognized capitalists, there is a high potential for threat or reward.

The regulations for certified capitalists differ amongst territories. In the U.S, the interpretation of a certified investor is put forth by the SEC in Policy 501 of Policy D. To be an accredited investor, an individual has to have an annual earnings exceeding $200,000 ($300,000 for joint income) for the last 2 years with the expectation of gaining the exact same or a higher income in the existing year.

An accredited capitalist should have a total assets going beyond $1 million, either individually or jointly with a spouse. This quantity can not consist of a key house. The SEC likewise thinks about applicants to be recognized financiers if they are general companions, executive police officers, or supervisors of a firm that is providing non listed protections.

If an entity is composed of equity proprietors that are approved investors, the entity itself is a recognized financier. A company can not be formed with the sole purpose of purchasing details safety and securities. A person can certify as an accredited financier by showing adequate education or job experience in the economic market.

Latest Posts

Property Tax Not Paid For 10 Years

How To Invest In Tax Lien

High Yielding Investments In Tax Lien Certificates